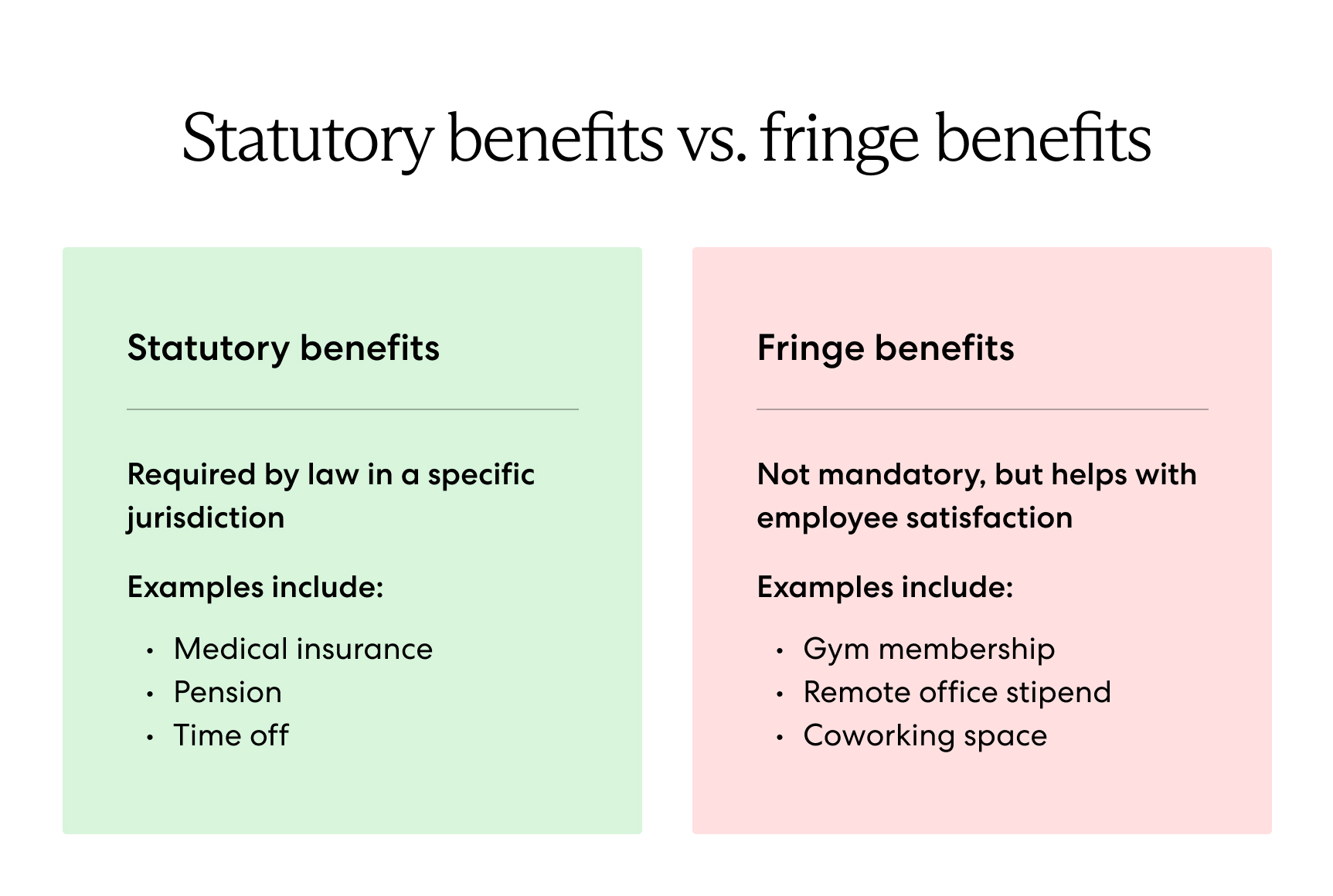

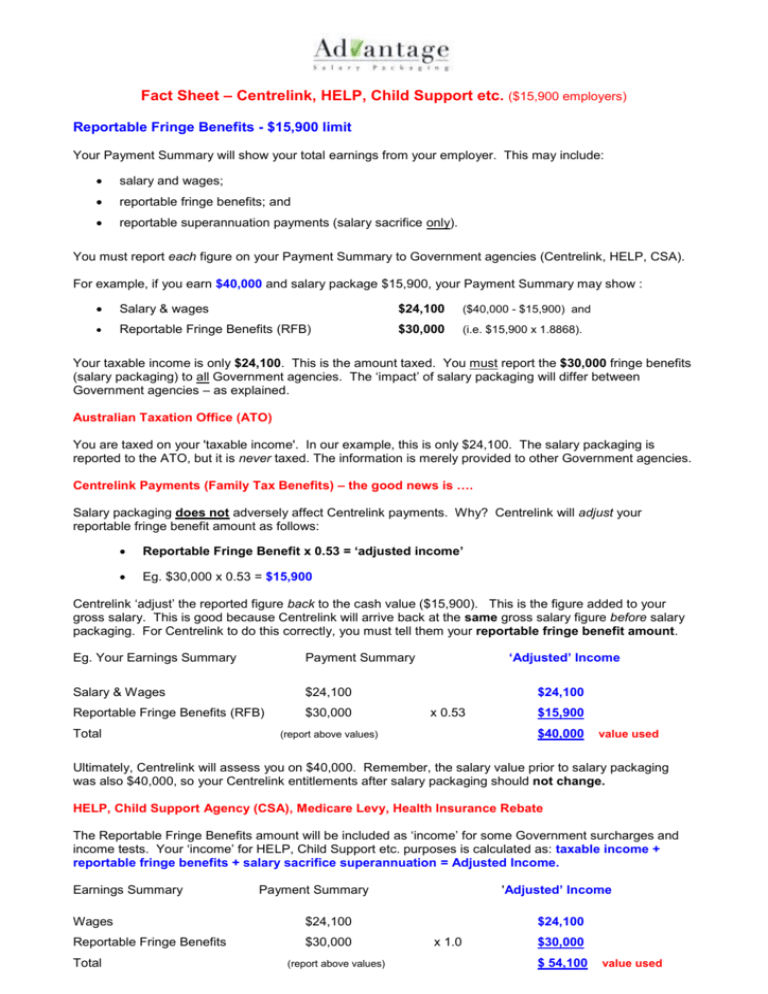

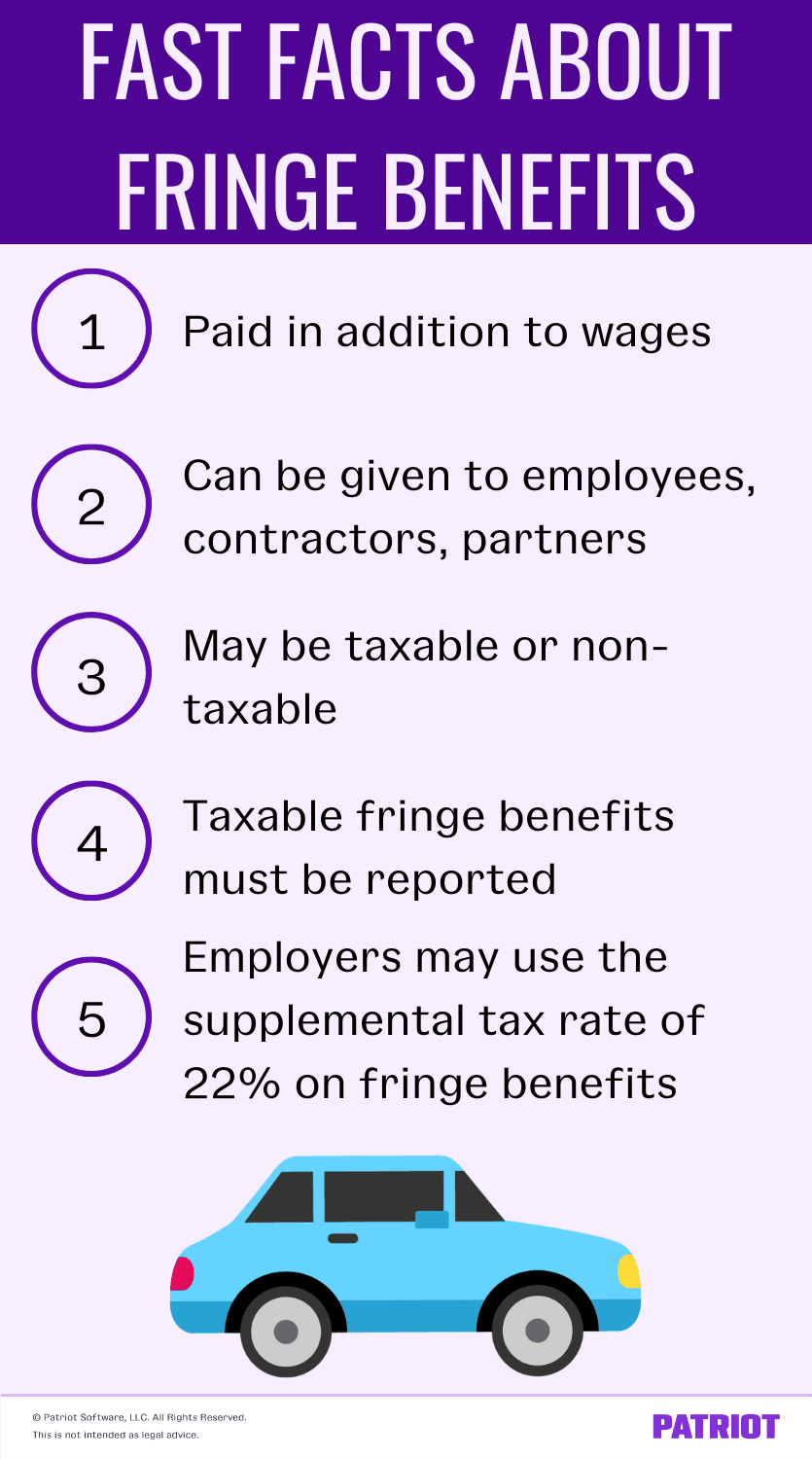

Reportable Fringe Benefits Salary packaging enables you to reduce your taxable salary, and as a result, pay less income tax. One of the. Employers are required to 'gross up' the value of your salary packaging benefit and record this on your PAYG payment summary as Reportable Fringe Benefits. 1800 555 582 | salary.com.au Page 1 of 2. Some employers may restrict the types of benefits that can be packaged or may not offer salary packaging at all. Fringe Benefits Tax (FBT): Some benefits may be subject to fringe benefits tax (FBT), which can impact the overall tax savings you receive from salary packaging. FBT is a tax paid by employers on certain non-cash benefits provided to.

Types of Employee Benefits 12 Benefits HR Should Know AIHR

What Are Fringe Benefits? It Business mind

Positive Salary Packaging Showcase SA

Salary Fringe Benefit_2021.pdf Google Drive

What employees expect from employee benefits packages

Salary Packaging For Health Employees YouTube

Fringe benefit, info utili l'assicurazione sulla vita CCSNews

What Are Fringe Benefits? Definition and Examples

Fact Sheet Advantage Salary Packaging

What is Salary Packaging and How Does it Work? Eziway

Discover salary packaging YouTube

Salary packaging worth the sacrifice? Integrity One

Employee Benefits Package Template Download & Edit

What are fringe benefits pros, cons, and challenges Sloneek®

What are Fringe Benefits? Definition, Types, and Examples

Job Offer Benefits Packages Can Be a Stronger Incentive than Salary HR Daily Advisor

The package of salary, incentives and fringe benefits designed in a way to motivate the

What Are Fringe Benefits? AIHR HR Glossary

What Are Fringe Benefits? It Business mind

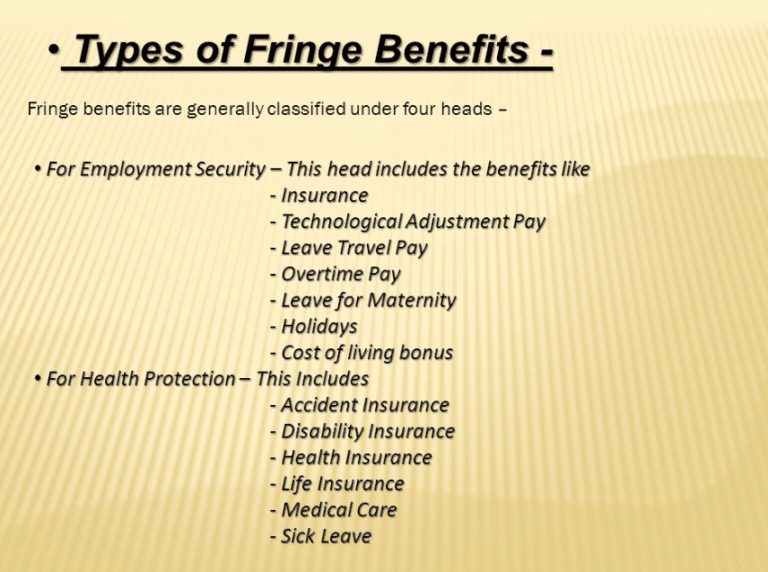

Reportable Fringe Benefits & Salary Packaging Pherrus

your reported salary packaging as follows: Adjusted Income = Taxable Wages + Reportable Fringe Benefits Amount Therefore, for someone earning $58,550 and salary packaging $15,900 + $2,650: If you have a FEE-HELP debt Your FEE-HELP payments will increase slightly. Send your details and gross income (before salary packaging e.g.. The types of things you can salary package will usually fall into one of three categories: fringe benefits, exempt benefits, and super. Fringe benefits A fringe benefit is a non-cash benefit you receive from your employer, instead of salary, on which your employer is liable to pay fringe benefits tax (FBT).